Past performance does not guarantee future results. Investments with Kopion may lose value.

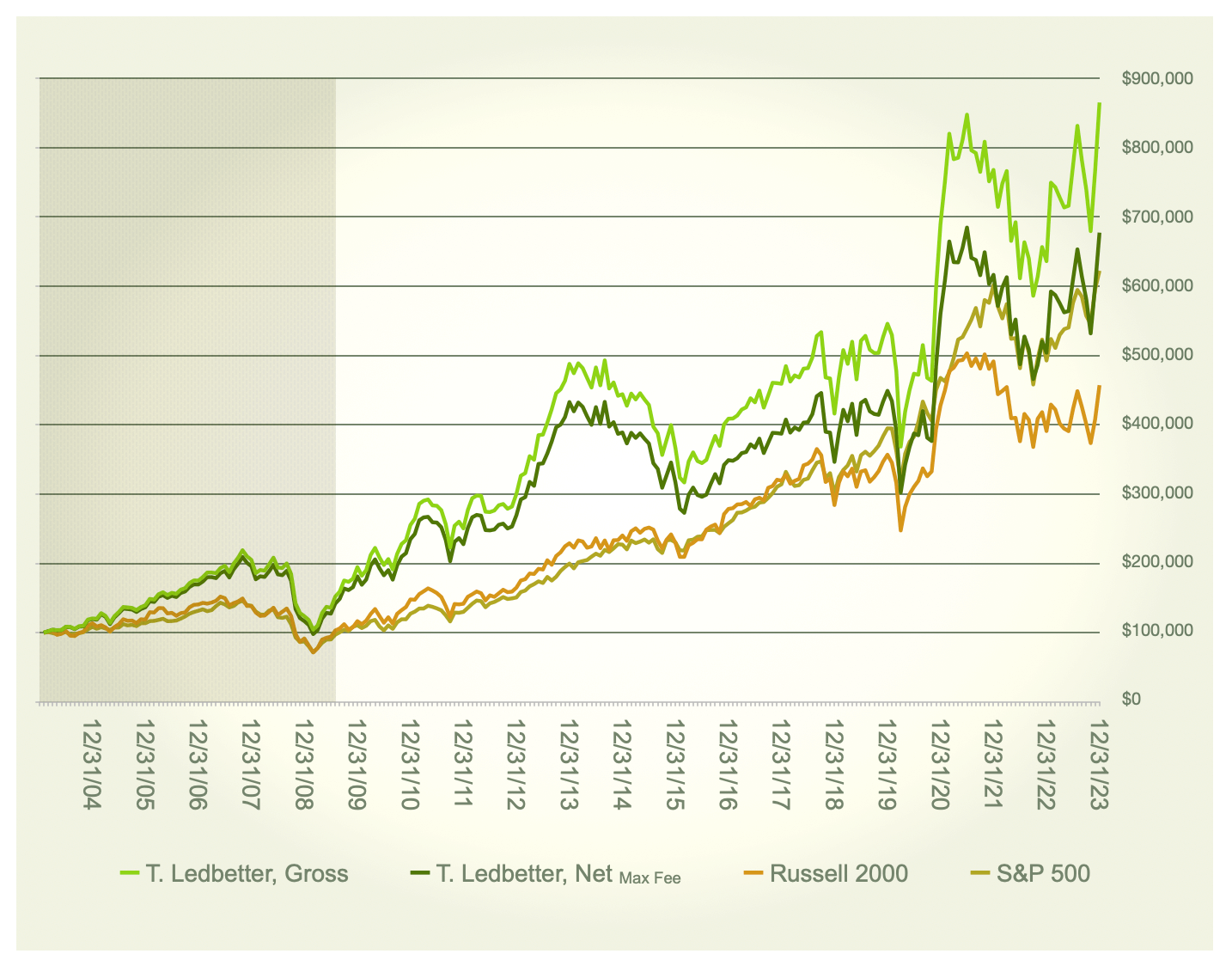

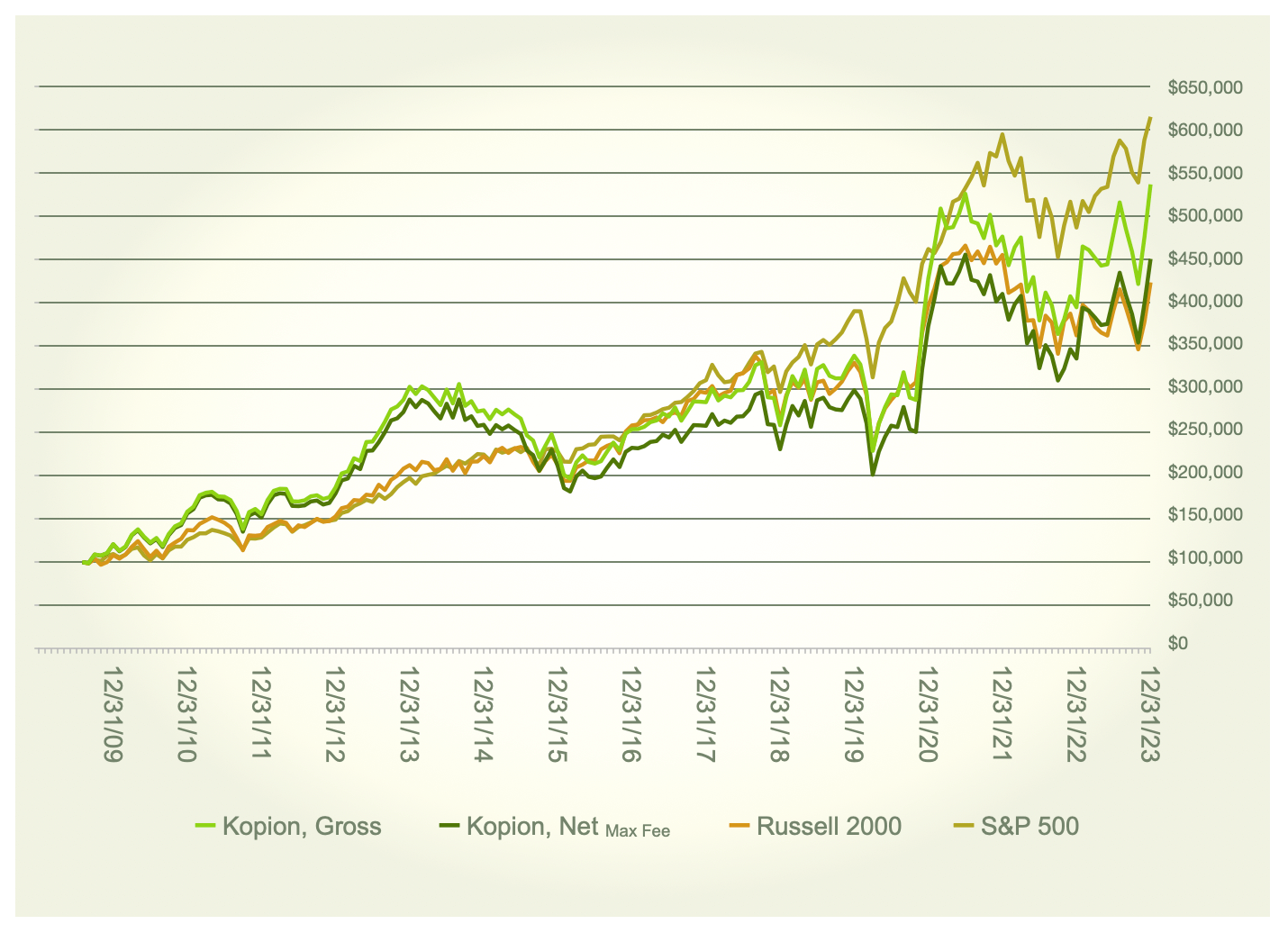

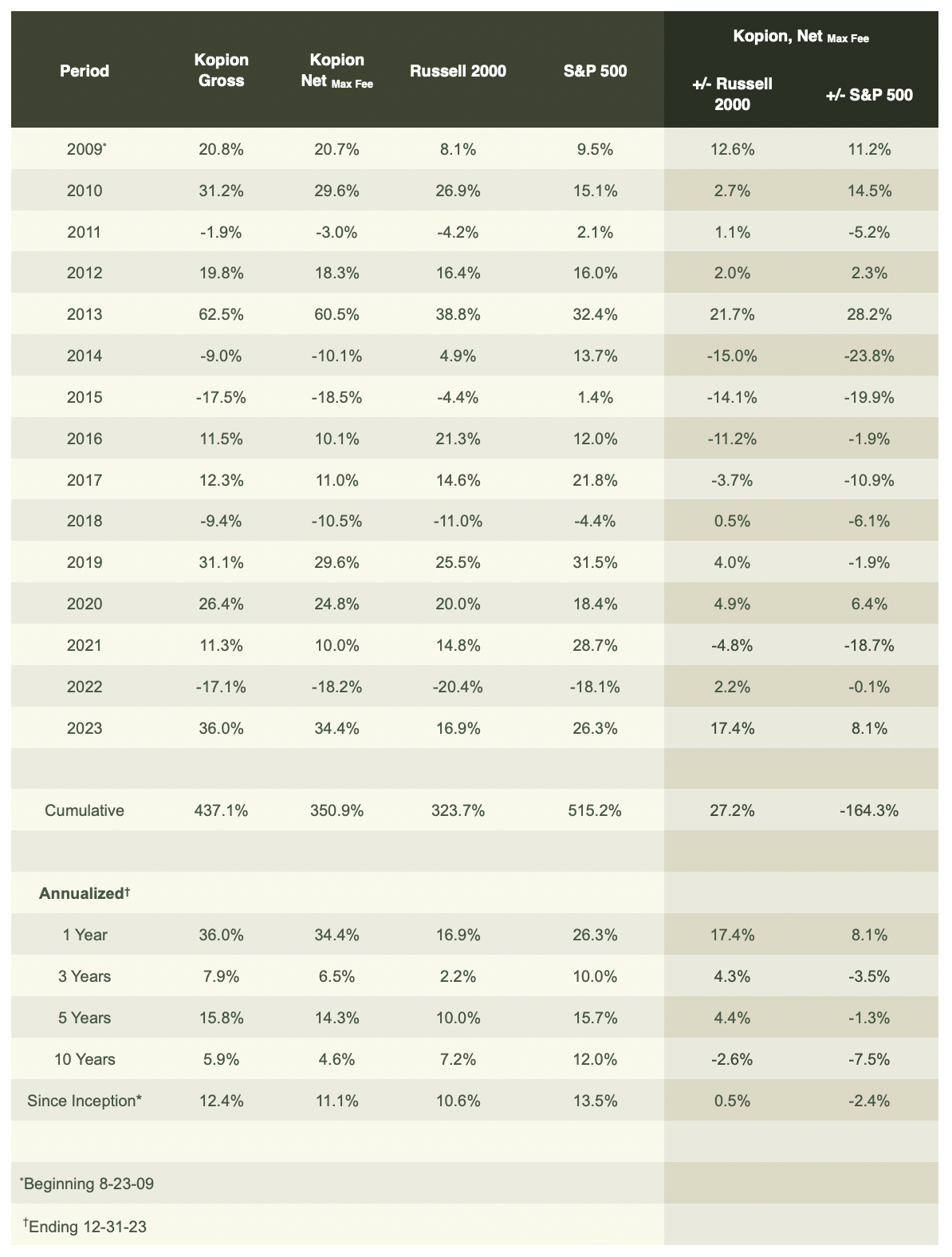

Terry Ledbetter, Jr. began managing his first diversified investment account on 2-4-04 while employed by Friedberg Investment Management (FIM). Mr. Ledbetter left FIM on 7-31-09 and founded Kopion Asset Management, LLC (Kopion), which became a legal entity on 8-24-09. Importantly, when Mr. Ledbetter founded Kopion, he continued to manage the same accounts that he had been managing while employed by FIM. The accounts, investment strategy, and investment process all remained the same. The performance information cited throughout Kopion’s marketing materials includes all of the diversified investment accounts managed directly by Mr. Ledbetter since 2-4-04, which is when he began managing his first diversified investment account. This information is provided for both Mr. Ledbetter’s entire performance history as well as for the portion of Mr. Ledbetter’s performance history that occurred after Kopion was founded and became a legal entity.

The performance information cited throughout Kopion’s marketing materials has been thoroughly documented, and it has been calculated using normal industry protocols, which are described in more detail below. This information has not, however, been audited by an independent third party. Dividend and interest income in these accounts was reinvested. Returns for these accounts have been asset-weighted to calculate historical returns. Said another way, the accounts were aggregated into a single group and then performance was calculated for that single group. This group includes some sub-accounts and securities that were carved out of larger accounts in order to exclude assets like mutual funds that Mr. Ledbetter did not manage directly. Those mutual funds were managed by professionals at third party firms, and Mr. Ledbetter’s involvement was limited to being a passive shareholder of those mutual funds. In addition, some of those mutual funds followed fixed income strategies, which were very different from the strategy used by Mr. Ledbetter when he was employed by FIM and later at Kopion. Performance information that includes assets like mutual funds that were not managed directly is available, and Kopion will provide it promptly upon request.

Kopion reports its Time Weighted Returns (TWRs). TWRs make adjustments for deposits and withdrawals so that those transactions do not influence performance results. Consequently, deposits do not increase the return, and withdrawals do not decrease the return. TWRs thus allow for performance comparisons between Kopion’s (and Mr. Ledbetter’s) history and market indices.

Kopion reports both “gross returns” (which are returns before Kopion’s management fee) and “net returns” (which are returns after deducting Kopion’s management fee). Kopion’s management fee schedule is graduated, which means that the fee rate begins to decrease after an account’s dollar value exceeds a certain threshold. The label “Net Max Fee” indicates that the net returns being presented reflect Kopion’s maximum fee rate for all periods presented. The words “net” or “after fees” without the words “Max Fee” in subscript lettering indicates that the net returns being discussed reflect actual fees.

Kopion has provided the returns of the Russell 2000 and the S&P 500 indices in order to provide the broader stock market context of Kopion’s (and Mr. Ledbetter’s) returns. The Russell 2000 tracks the performance of relatively small publicly traded companies, and the S&P 500 tracks the performance of relatively large ones. Kopion does not “benchmark” its portfolio against indices in the traditional sense of carefully managing the portfolio for comparison against a specific index. Instead, these two indices are used as broad indicators of the stock market’s performance. Kopion (and Mr. Ledbetter) has primarily focused on small and medium sized firms, but it (and he) has also invested in some large companies as well. This is why Kopion has provided the results of both the Russell 2000 and the S&P 500. These indices cannot be invested in directly, but mutual funds and exchange-traded funds that track these indices (“index funds”) are available in the market. Kopion’s (and Mr. Ledbetter’s) investment strategy carries more risk than investing in an index fund that tracks either the Russell 2000 or the S&P 500. This is primarily because Kopion’s (and Mr. Ledbetter’s) strategy involves investing in a relatively small number of stocks and those stocks are primarily for small to medium sized companies. This approach results in greater volatility and greater risk of capital loss than index funds tracking either the Russell 2000 or the S&P 500.

Indices’ performance figures have been obtained from sources believed to be reliable.